ABOUT

FINANCIAL LITERACY FOR ALL is a non-profit 501(c)(3) organization

focused on providing financial literacy training to students and young adults in under-served communities.

Through workshops that foster greater understanding of budgeting, saving, borrowing, investing and philanthropy we hope to contribute to the financial wellness of the next generation.

THE TEAM

MEDINA JETT, JD, MBA

Medina Jett is the Co-Founder and Chairman of Financial Literacy For All, Inc. Medina is an attorney as well as a business owner. Her career has been focused on providing legal, compliance and operational expertise to the financial services industry. After a successful career in Corporate America, she launched her own company over 10 years ago. She now helps those companies entrusted with investing assets on behalf of others comply with all applicable regulations.

Medina is a social justice advocate who believes that education is the great equalizer and that strong financial literacy is the foundation upon which financial freedom can be built. In 2013 Medina was named a Wonder Woman by the Malta House of Care for her achievements both professionally and in the community. In 2014 The Hartford Courant Business Section featured Medina on its center page for her having left the C-Suite to pursue her dream of owning her own business. In 2015 ICSGroup was named The Best Small Business Start-Up by the Metro Hartford Alliance and the Harford Business Journal for its revenue growth, innovation and community involvement. In 2016 Medina was named a Most Powerful and Influential Woman by the Tri-State Diversity Council and a Woman of Inspiration by the Connecticut Women and Education Legal Fund. In 2016, her company was selected from among thousands of small business owners to participate in the Goldman Sachs 10,000 Small Businesses Program. In 2017 she was the recipient of the Anti-Defamation League’s Torch of Liberty Award in recognition of her work in the community to eradicate social injustice and provide greater educational opportunities for under-privileged youth.

Medina was appointed to the State of Connecticut Department of Banking’s Securities Advisory Council. She is a member of the Connecticut Bar, the Women’s Association of Venture and Equity, 100 Women in Finance, the National Bar Association and the National Black MBA Association. She is a frequent speaker on the national stage on legal and compliance topics, entrepreneurship, women in business, effective networking, achieving work/life balance and financial wellness.

Medina is a member of the Board of Trustees of Hopkins School where she advocates for minority students from New Haven to have the same access to the education and financial resources that were available to her. She also serves on the President’s Advisory Council at Wesleyan University. Medina has served on the board of trustees of the Amistad Center for Art & Culture; the Wadsworth Atheneum Museum of Art; and the Hartford Youth Scholars, an organization dedicated to changing the lives of Hartford students through education. Medina is a member of Alpha Kappa Alpha Sorority, Inc. She has 3 children, including the Co-Founder of Financial Literacy For All, Andre Jett.

Medina is a graduate of Hopkins School in New Haven, Wesleyan University, Georgetown University Law Center, and the University of Connecticut School of Business.

ANDRE JETT

Andre Jett is the Co-Founder and President of Financial Literacy For All, Inc. Always concerned about the well-being of others Andre has begun his journey to social entrepreneurship at an early age. He has gained valuable experience working as an intern at Fairview Capital, a multi-billion dollar private equity firm; at ICSGroup, a legal and compliance advisory firm serving the financial services industry; and most recently at Cronin & Co, an advertising agency serving the for-profit and not-for-profit sectors. While Andre’s career interests are in marketing and advertising, he is driven by a desire to help young people like himself learn the critical financial management skills which are the basis for financial wellness and ultimately financial independence. Andre enjoys leading workshops of his peers and sharing his insights about credit, debt, budgeting and the benefits of long-term saving.

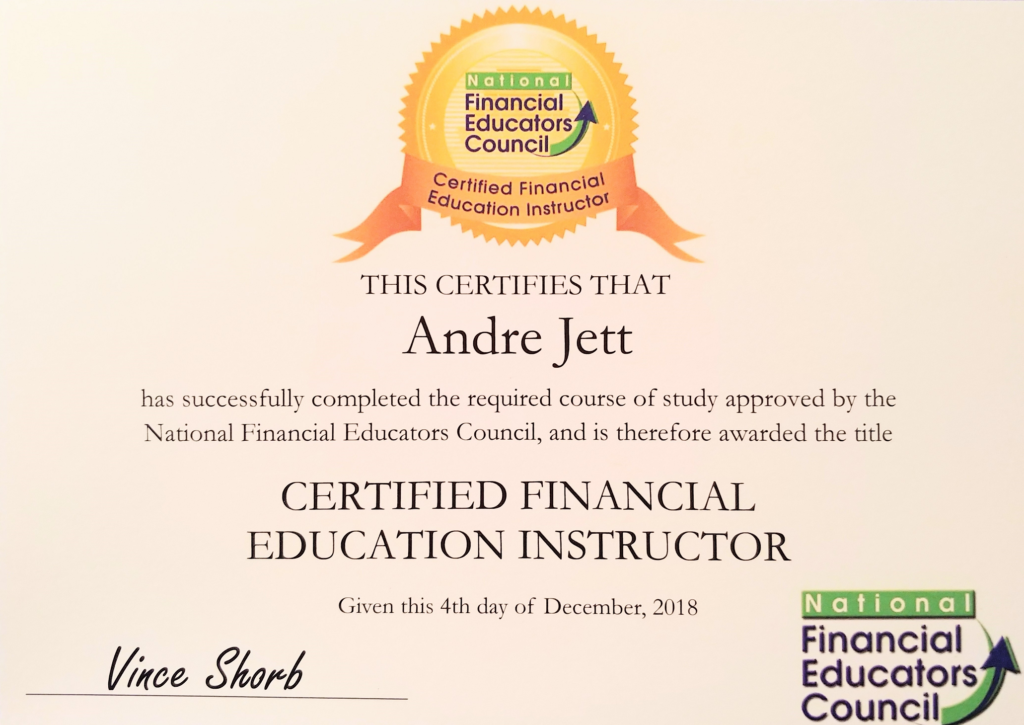

Andre learned the value of saving at an early age when he was forced to deposit the money he earned as a child model and the monetary gifts he received for birthdays and Christmas. Andre later came to appreciate the value of saving money and the flexibility it provides. He has been a student of investing and looks forward to starting his 401(k) plan when he starts his first full-time job after college. Having a mother in financial services, Andre was bound to be focused on financial wellness, but, rather than rely on second-hand knowledge, Andre successfully completed the National Financial Education Council’s financial literacy training course and has earned his certification as a Financial Education Instructor.

Andre is a graduate of Kingswood Oxford School in West Harford, Connecticut where he was one of the captains of the Varsity Football Team and helped lead his team to victory in the New England Private School Association Championship. He is currently a student at Morehouse College. He hopes to one day become financially independent while continuing to serve his community.

OUR SERVICES

We offer financial literacy training for high school and college students and young adults. Training is delivered in an interactive workshop structure and includes hands-on activities to ensure knowledge is retained and can be implemented well beyond the class. We cater to youth groups, schools, church groups and professional organizations. Non-profit organizations will receive special pricing.

Junior High School Grade Students

Have a group?

Contact us to schedule your private 2 hour workshop.

COURSE OUTLINE:

Establishing a Mindset about Money

- Needs versus Wants

- Spending versus Saving

- An Introduction to Saving

- Understanding the Cost of Living

- Activity

High School Students

Have a group?

Contact us to schedule your private 2 hour workshop.

COURSE OUTLINE:

Strategies for Financial Wellness

- Budgeting

- Saving

- Understanding the Concept of Debt

- Activity

College Students

Have a group?

Contact us to schedule your private 2 hour workshop.

COURSE OUTLINE:

- Saving

- Budgeting

- Compounded Interest

- Managing Credit Cards

- Credit Score

- Student Loans

Young Adults

Have a group?

Contact us to schedule your private 2 hour workshop.

COURSE OUTLINE:

Strategies for Financial Wellness

- Budgeting

-

Developing a Philosophy About Money

-

Banking and Saving

-

Budgeting

-

Using Credit Cards

-

Understanding Income Taxes

-

Retirement Accounts

-

Insurance/Risk Management

-

Purchasing a Car

-

Purchasing a Home

-

Establishing Multiple Streams of Income

-

Setting Short and Long-Term Goals